S&P 500 Jumps After Fed Pivots on 2024 Rate Cuts

The S&P 500 (Index: SPX) rose for the seventh week in a row. The index closed out the week at 4719.19, almost a 2.5% increase over where it closed the previous week.

Almost all of that upward movement came on Wednesday, 13 December 2023 after 2:00 PM, when the Federal Reserve first announced it would hold the Federal Funds Rate steady in a target range of 5.25 to 5.50%, then signaled in the following press conference by Federal Reserve Chair Jerome Powell that the U.S. central bank would pivot to cut interest rates in 2024. The change effectively reverses the expectation the Fed would continue following a more hawkish policy that had been voiced by Powell as recently as 1 December 2023.

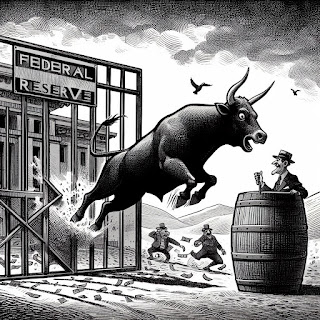

After the bulls were let loose on Wednesday, the S&P drifted slightly higher through the rest of the week as Fed officials sought to walk back some of the change in expectations for the course of how interest rates would change during 2024 they had unleashed.

These changes are captured in the latest update of the alternative futures chart. We’ve also added a new redzone forecast range to account for the echoes of past volatility that arises from the dividend futures-based model‘s use of historic stock prices as the base reference points from which it projects the potential trajecgtories of the S&P 500 into the future.

This new redzone forecast range assumes investors will shift their forward-looking focus from 2024-Q4, where we established it was in the previous edition of the S&P 500 chaos series, back toward 2024-Q1, which coincides with the expected timing of when investors anticipate the Fed will start cutting interest rates.

That change in the forward time horizon of investors wasn’t the only expectation that changed during the past two weeks. The outlook for dividends has also substantially improved during the past month, as shown in the next chart.

Nearly all of the change in the outlook for dividends in 2024 took place during the past two weeks.

Other things also happened during the trading week ending on Friday, 15 December 2023. Here is our summary of the week’s market moving headlines.

- Monday, 11 December 2023

-

- Signs and portents for the U.S. economy:

- Oil settles slightly higher, investors still wary

- Global trade to contract by 5% in 2023, UN body says

- Speculation builds Fed minions will end quantitative tightening in 2024, Fed minions say Americans are right to be gloomy:

- Sharp Fed liquidity drain hints at early end for balance sheet runoff

- US public’s downbeat view of economy is real, Chicago Fed research shows

- Bigger stimulus, trouble developing in China:

- China’s leaders meet to discuss growth targets for 2024, say sources

- China’s consumer prices fall fastest in 3 years, factory-gate deflation deepens

- BOJ minions not quite ready to end never-ending stimulus:

- Nasdaq, S&P, Dow start week with gains as traders gear up for CPI data, Fed rate decision

- Tuesday, 12 December 2023

-

- Signs and portents for the U.S. economy:

- Oil holds soft tone on oversupply concerns, markets await Fed

- Stubbornly high rental costs lift US consumer inflation in November

- Bigger trouble dodged in China, for now, while bigger stimulus develops:

- China’s Country Garden may avoid yuan bond default after deal – Bloomberg News

- China says it will step up policy adjustments to spur recovery in 2024

- BOJ minions looking to keep never-ending stimulus alive a little longer:

- Nasdaq, S&P, Dow end higher after latest CPI report; focus turns to Fed rate decision

- Wednesday, 13 December 2023

-

- Signs and portents for the U.S. economy:

- Oil prices up 1% on big U.S. storage withdrawal, tanker attack in Red Sea

- US bankruptcy wave may stretch into 2024, but pace could slow

- Expectations before the Fed minions’ meeting:

- Fed minions to swing to rate cuts in 2024, noncommittal on ending quantitative tightening:

- With rate hikes likely done, Fed turns to timing of cuts

- US rate futures lift March rate cut bets after Fed flags end of tightening

- Fed ‘Dots’ Signal Major Dovish Pivot For Election Year

- Fed’s Powell not ready to say when balance sheet wind-down ends

- Bigger stimulus developing in China:

- BOJ minions try to play coy after signaling the end of never-ending stimulus is coming:

- Bigger trouble developing in the Eurozone:

- S&P, Nasdaq rise while Dow scales 37K for new record high after Fed sees rate cuts in 2024

- Thursday, 14 December 2023

-

- Signs and portents for the U.S. economy:

- US economy still resilient as retail sales beat expectations, layoffs stay low

- US mortgage rates fall below 7% for first time since August

- Fed minions expected to deliver rate cuts sooner:

- Fed seen pivoting to interest rate cuts in March, perhaps earlier

- Fed rarely cuts rates at a ‘measured pace’

- Bigger stimulus developing in China:

- BOJ minions looking to exploit Japan government political scandal:

- ECB, BOE minions claim they don’t want to cut rates:

- Fed stands alone as ECB, BoE stick with tight policy

- Nasdaq, S&P, Dow end higher as Fed pivot rally continues despite some buying fatigue

- Friday, 15 December 2023

-

- Signs and portents for the U.S. economy:

- Oil prices take a small loss in seesaw session

- CBO projects 1.5% U.S. GDP growth in 2024, 4.4% jobless rate

- US PMIs Suggest “Weak GDP Growth” In Q4, Prices Remain “Elevated”

- Fed minions try to put damper on dovish pivot:

- Fed’s Williams douses Wall Street’s rate-cut speculation

- Exclusive: Fed’s Bostic sees two rate cuts, soft landing next year

- Calls for bigger stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- Nasdaq, S&P, Dow notch seven-week win streak after Fed’s dovish pivot

The CME Group’s FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 20 March 2023 (2024-Q1), six weeks earlier than expected a week ago, when the Fed is expected to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The Atlanta Fed’s GDPNow tool‘s estimate of real GDP growth for the current quarter of 2023-Q4 rose to an annualized growth rate of 2.6% after having held steady at a +1.2% growth rate during the preceding two weeks. The Atlanta Fed’s nowcast increased thanks to reports of higher personal and government spending figures along with higher business investments in the past week.

This article is the last for the S&P 500 chaos series in 2023. We’ll be back with a new edition covering the last weeks of December 2023 sometime early in 2024!

Image credit: Microsoft Bing Image Creator. Prompt: “An editorial cartoon of a bull escaping from a pen after the gate has been opened by a Federal Reserve official.”

Source: https://politicalcalculations.blogspot.com/2023/12/s-500-jumps-after-fed-pivots-on-2024.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).